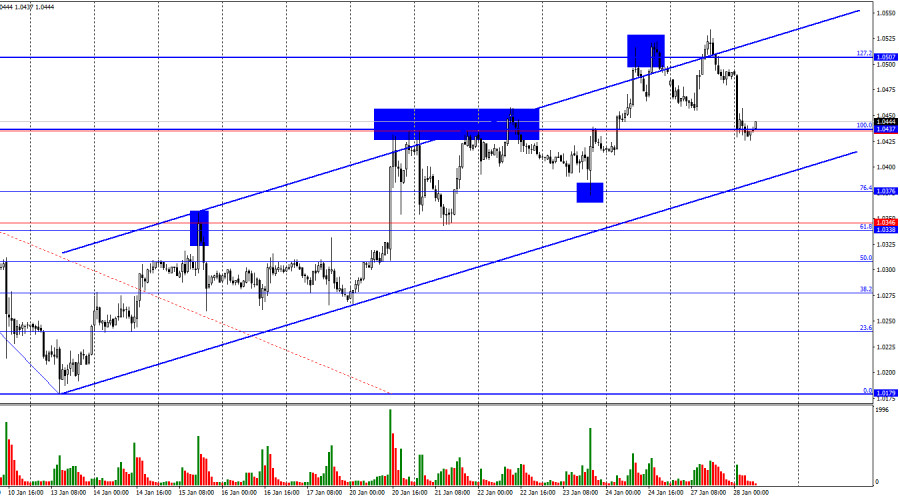

On Monday, the EUR/USD pair reversed near the 127.2% corrective level at 1.0507 in favor of the US dollar and fell toward the 100.0% corrective level at 1.0437. A rebound from this level could signal a reversal in favor of the euro and a renewed rise within the upward channel toward the 1.0507 level. Conversely, a consolidation below 1.0437 would increase the likelihood of continued decline.

The wave structure remains clear. The last completed downward wave broke the low of the previous wave, while the most recent (still incomplete) upward wave has broken through the last two peaks. This indicates that the bearish trend is considered completed. In the near term, a new downward wave may begin to form, but for the bears to initiate a new trend, they must push the pair back toward the 1.0179 level. Alternatively, they could form a more complex wave structure to regain control.

On Monday, the economic news flow was nearly absent. ECB President Christine Lagarde delivered a new speech, but she focused more on the independence of central banks rather than on monetary policy or interest rates. As a result, her remarks failed to provoke a reaction from traders—and likely weren't intended to. Meanwhile, traders are already in a wait-and-see mode ahead of two major central bank meetings. Tomorrow evening, the results of the FOMC meeting will be announced, followed by the ECB meeting on Thursday. In my opinion, both events could support bearish traders, though it is impossible to predict this with certainty. If the market senses a dovish shift in Jerome Powell's rhetoric, it could be detrimental to the US dollar. While I don't believe the dollar will remain under pressure throughout 2025, the market is currently anticipating a maximum of two rate cuts. Should Powell indicate the possibility of more substantial cuts, this could cause significant disappointment among dollar bulls. Graphically, the dollar may see strong growth if the pair closes below the ascending channel.

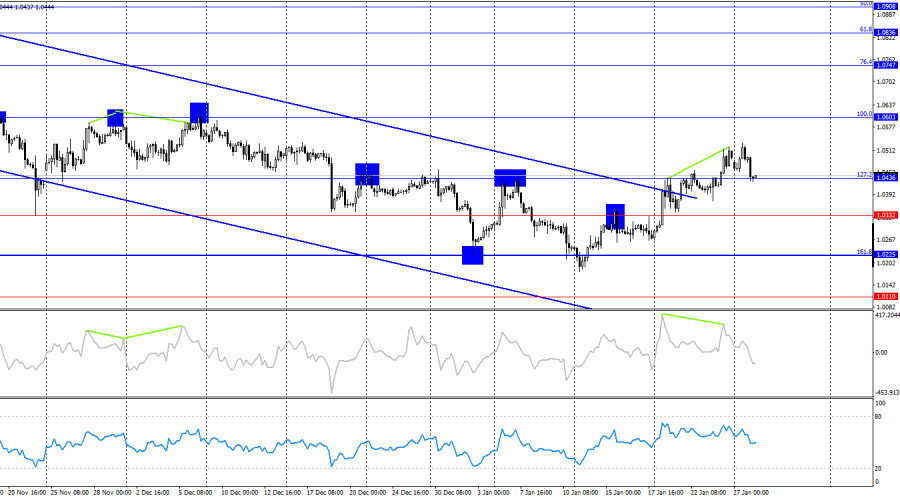

On the 4-hour chart, the pair consolidated above the 127.2% corrective level at 1.0436. This suggests that the upward movement may continue toward the next Fibonacci level of 100.0% at 1.0603. The euro has also broken out of the downward trend channel. While the trend is gradually shifting to bullish, it remains uncertain how long this trend will last. A bearish divergence in the CCI indicator suggests a potential decline in the near term, but the bears have yet to achieve a close below 1.0436.

Commitments of Traders (COT) Report

During the last reporting week, professional traders opened 4,905 long positions and 6,994 short positions. The sentiment of the Non-commercial group remains bearish, suggesting the potential for further declines in the pair. The total number of long positions held by speculators now stands at 167,000, compared to 230,000 short positions.

For eighteen consecutive weeks, major players have been selling the euro, indicating a bearish trend without exceptions. Occasionally, bulls dominate during specific weeks, but these instances are more of an anomaly. The primary driver of dollar weakness—the market's expectation of dovish FOMC policy—has already been priced in. While new reasons to sell the dollar could emerge over time, the likelihood of its recovery remains higher. Chart analysis also supports the continuation of the long-term bearish trend. As a result, I expect the EUR/USD pair to continue its decline.

News Calendar for the US and Eurozone:

- US: Durable Goods Orders (13:30 UTC).

- Eurozone: ECB President Christine Lagarde Speech (17:00 UTC).

On January 28, the economic calendar includes another Lagarde speech and a key US report. The overall impact of the news on market sentiment today is expected to be moderate.

EUR/USD Forecast and Recommendations:

- Sell Opportunities: Consider selling the pair after a consolidation below the upward trend channel on the hourly chart. The likelihood of a long-term trend shift to bullish remains high.

- Buy Opportunities: Buying is possible today on a rebound from the 1.0437 level on the hourly chart, with a target of 1.0507.

Fibonacci Levels:

- Hourly Chart: 1.0437–1.0179.

- 4-Hour Chart: 1.0603–1.1214.