The GBP/USD currency pair showed significant growth during the day but fell sharply by the end of the day. The "show" began early in the morning when the UK released its inflation report, which was even more intriguing than the U.S. inflation data. The UK's Consumer Price Index (CPI) decreased from 2.6% to 2.5% year-over-year. What does this indicate? It suggests that the Bank of England (BoE) might accelerate its monetary policy easing. The central bank's primary concern is no longer inflation (which it has managed to bring down somewhat) but economic growth, which has been hovering around zero for two years. Consequently, interest rate cuts are needed to stimulate the British economy. If inflation is declining, the BoE can reduce rates more aggressively. So far, the BoE has barely begun cutting rates. Thus, 2025 could be the year of a significant easing of its hawkish stance.

BoE Governor Andrew Bailey mentioned the possibility of four rate cuts this year. However, the rate could be lowered five or even six times. What does this mean for the pound? It implies that the currency could continue its decline. The BoE may cut rates five times, while the Fed is expected to cut only once. Which currency has better growth prospects in this scenario?

The core inflation rate also dropped to 3.2% from 3.5% (against forecasts of 3.4%), providing another reason for the pound's potential weakness and further monetary easing by the BoE. We were surprised not to see a new drop in the pound in the first half of Wednesday. However, as we noted, U.S. inflation data often carries more weight for the market. In the U.S., headline CPI rose to 2.9%, while core CPI declined to 3.2%. This creates a mixed report, but the key takeaway remains: U.S. inflation is increasing. We believe this is the start of another corrective phase for the pound. It could last several weeks, as the daily timeframe shows a lack of corrections in recent months. However, the global downtrend remains intact, and yesterday's fundamental backdrop for the pound did not improve significantly.

From a technical standpoint, the correction can be easily explained. In recent weeks and months, the CCI indicator has generated multiple buy signals for both the euro and the pound, including divergences and indications of being in the oversold zone. However, it's important to remember—something many traders overlook—that when oscillators generate buy signals during a downtrend, they typically signify corrections rather than a reversal of trend. In this instance, the pound may rise to the 1.2400 or even 1.2500 level, but this will not change the overall downtrend. Once the BoE begins to ease policy at every meeting, the pound could plunge again dramatically.

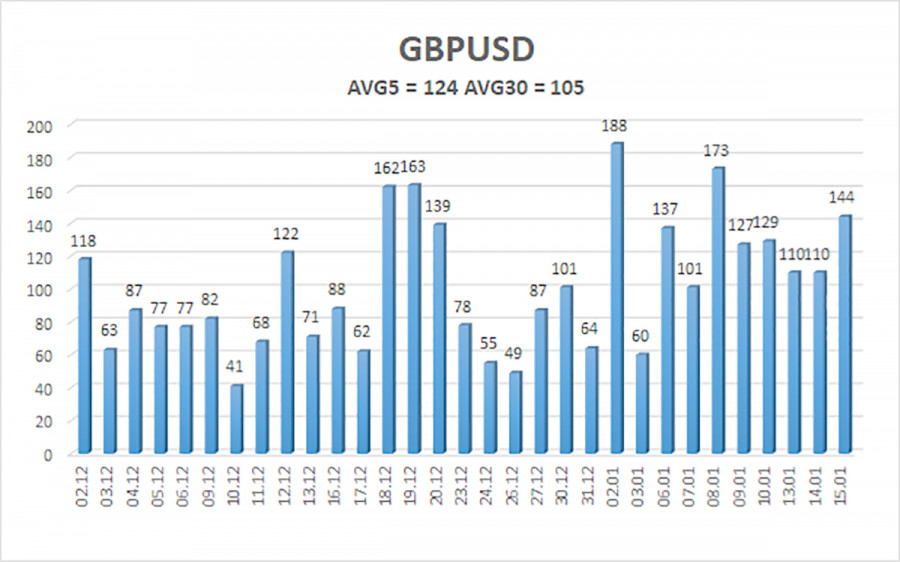

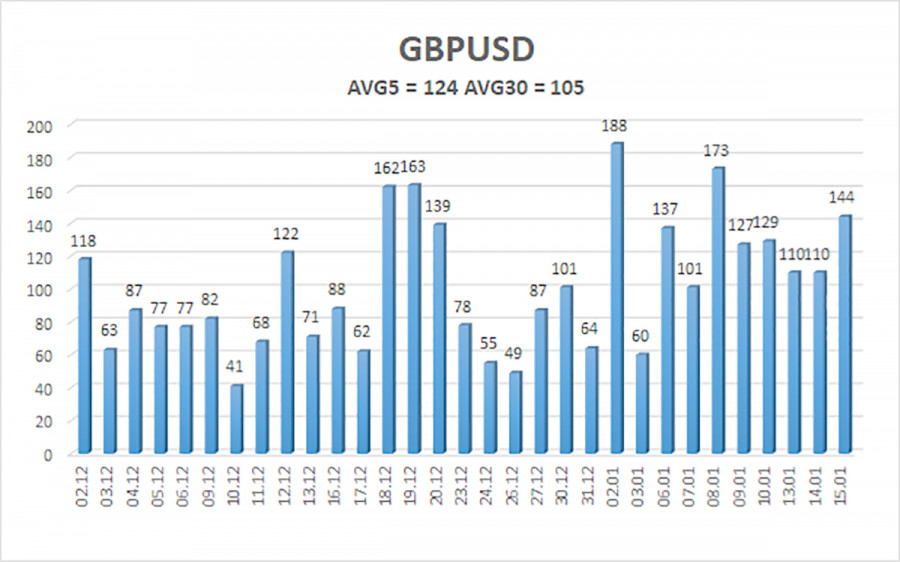

The average volatility of the GBP/USD pair over the last five trading days is 124 pips, which is considered high for this pair. Therefore, on Thursday, January 16, we expect the pair to move within the range of 1.2085 to 1.2334. The higher linear regression channel remains downward, indicating a continued downtrend. The CCI indicator has once again entered the oversold zone; however, in a downtrend, an oversold condition is merely a signal for correction. The bullish divergence previously indicated by this indicator also suggested a correction, which has now concluded.

Nearest Support Levels:

- S1: 1.2207

- S2: 1.2085

- S3: 1.1963

Nearest Resistance Levels:

- R1: 1.2329

- R2: 1.2451

- R3: 1.2512

Trading Recommendations:

The GBP/USD pair continues to be in a downtrend. We are avoiding long positions, as we believe that all factors contributing to the British currency's growth have already been priced in by the market multiple times, with no new catalysts on the horizon. If you are trading based on pure technical analysis, long positions may be considered with targets at 1.2329 and 1.2390, provided the price remains above the moving average. Sell orders remain more relevant, with targets set at 1.2146 and 1.2085.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.