Analysis of Trades and Trading Tips for the British Pound

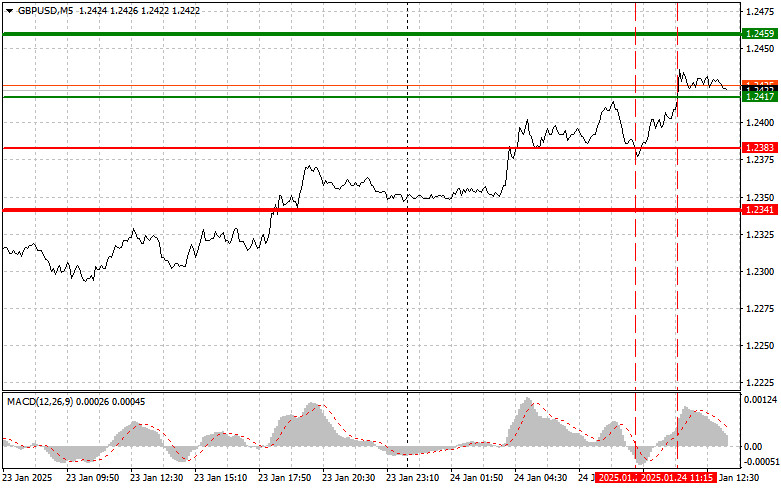

The test of the 1.2417 price level occurred when the MACD indicator had moved significantly above the zero mark, clearly limiting the pair's upward potential. For this reason, I did not buy the pound. Similarly, the test of the 1.2383 price level did not allow me to enter the market for selling the pound, as the MACD indicator was far from the zero mark at the time of the level's update.

Improved PMI data from the UK has been a significant factor contributing to positive market changes. Traders, taking into account new economic indicators, began to revise their investment strategies, which led to increased demand for the British pound. Survey results in the services and manufacturing sectors showed higher activity levels than expected, fueling investor optimism. This positive trend creates favorable conditions for further pound growth, opening up new opportunities for speculators and long-term investors. The recovery of the UK economy and the improvement of key indicators provide a basis for expecting currency support in the near term. However, potential risks should not be ignored, including external factors such as changes in the global economy or U.S. policy.

In the second half of the day, a significant amount of statistics is expected. It begins with PMI indices from the U.S. and concludes with data on consumer sentiment from the University of Michigan, inflation expectations from the University of Michigan, and existing home sales. PMI indices, particularly those for manufacturing and non-manufacturing sectors, provide insights into current business trends. Readings above 50 generally signal growth, potentially encouraging investors to act in favor of buying the U.S. dollar.

The consumer sentiment index and inflation expectations are also key in determining consumer spending trends. Higher inflation expectations may push consumers to increase spending now to avoid higher prices in the future, which, in turn, could boost economic activity. Additionally, data on existing home sales will be critical, as it reflects the health of the real estate market. An increase in sales could indicate economic recovery, while a decline might point to potential issues in consumer confidence and financial stability.

For intraday strategy, I will focus primarily on implementing Scenarios #1 and #2.

Buy Signal

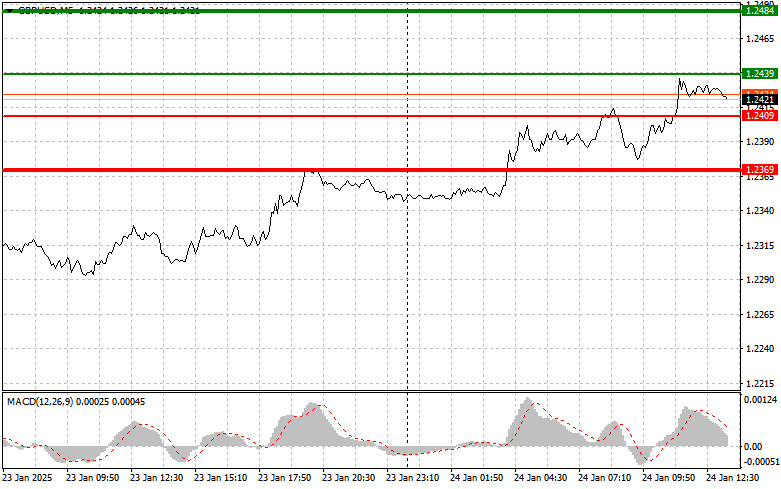

Scenario #1: Today, I plan to buy the pound at the entry point near 1.2439 (green line on the chart) with a target of reaching the 1.2484 level (thicker green line on the chart). At 1.2484, I will exit purchases and open sell positions, aiming for a 30–35-point movement in the opposite direction from the entry point. The pound's growth today is expected to continue its upward trend.Important! Before buying, ensure that the MACD indicator is above the zero mark and just beginning its upward movement.

Scenario #2: I also plan to buy the pound today in the event of two consecutive tests of the 1.2409 level when the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to a market reversal upwards. Growth toward the opposite levels of 1.2439 and 1.2484 can be expected.

Sell Signal

Scenario #1: I plan to sell the pound today after the level of 1.2409 (red line on the chart) is updated, leading to a quick decline in the pair. The key target for sellers will be the 1.2369 level, where I will exit sell positions and open buy positions immediately, aiming for a 20–25-point move in the opposite direction. Sellers will likely show activity if U.S. statistics are strong.Important! Before selling, ensure that the MACD indicator is below the zero mark and just beginning its downward movement.

Scenario #2: I also plan to sell the pound today in the event of two consecutive tests of the 1.2439 level when the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a market reversal downward. A decline toward the opposite levels of 1.2409 and 1.2369 can be expected.

Chart Details:

- Thin Green Line: Entry price for buying the trading instrument.

- Thick Green Line: Target price for setting Take Profit or manually securing profits, as further growth above this level is unlikely.

- Thin Red Line: Entry price for selling the trading instrument.

- Thick Red Line: Target price for setting Take Profit or manually securing profits, as further declines below this level are unlikely.

- MACD Indicator: Key for market entry, focusing on overbought and oversold zones.

Important Note for Beginner Forex Traders

Be extremely cautious when deciding to enter the market. Before key fundamental reports are released, it is often best to stay out of the market to avoid sharp price swings. If you choose to trade during news releases, always use stop-loss orders to minimize losses. Without stop-loss orders, you risk quickly losing your entire deposit, especially if you trade large volumes without proper money management.

And remember, successful trading requires a clear trading plan, such as the example provided above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for an intraday trader.