Trade Review and British Pound Trading Recommendations

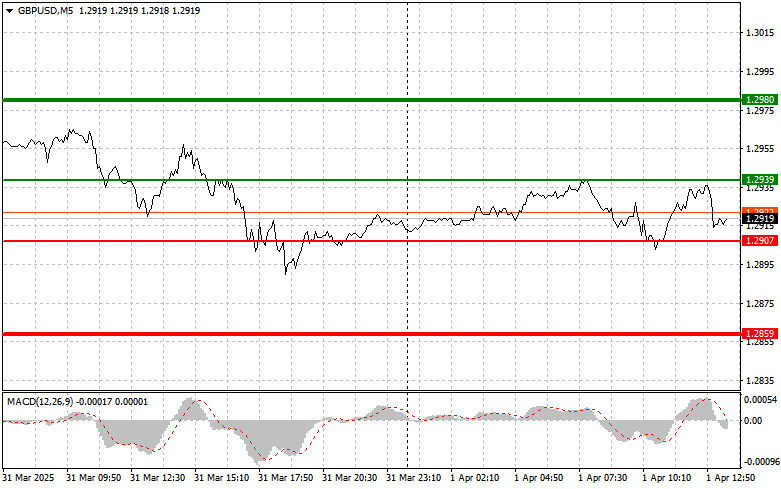

The test of the 1.2925 level occurred just as the MACD indicator was beginning to move down from the zero line, confirming a valid entry point for selling the pound. As a result, the pair dropped by 20 points, although it didn't quite reach the target level.

A mediocre UK manufacturing PMI, which remained below the 50-point threshold, pressured the pound. The released data indicated ongoing issues in the manufacturing sector, raising concerns among investors about the UK's economic growth prospects. A weak PMI is often seen as a sign of slowing economic activity, which in this case reinforced bearish sentiment toward the pound. Weak economic data may push the Bank of England to continue cutting interest rates, reducing the pound's appeal for yield-seeking investors.

In the second half of the day, similar data is expected from the United States. The focus will be on the U.S. ISM Manufacturing PMI and the Job Openings and Labor Turnover Survey (JOLTS) from the Bureau of Labor Statistics. The market will closely analyze these reports, as they may shed light on the current state of the U.S. economy and potentially influence future monetary policy decisions by the Federal Reserve.

The ISM index, in particular, is a key gauge of manufacturing activity—values above 50 indicate expansion, while those below 50 suggest contraction. JOLTS data, which reflect job openings and turnover, are also important as they indicate labor market demand and worker sentiment. A high number of job openings signals confidence from companies and willingness to hire, while high turnover may indicate workers searching for better opportunities. Strong data would support further dollar strength.

As for the intraday strategy, I'll primarily rely on the implementation of scenarios #1 and #2.

Buy Signal

Scenario #1: I plan to buy the pound today after reaching the 1.2939 entry point (green line on the chart), aiming for a rise to 1.3018 (thicker green line). I'll exit long positions near 1.2980 and open short positions in the opposite direction (expecting a 30–35 point pullback). A rise in the pound is only likely after weak U.S. data. Important! Before buying, ensure that the MACD indicator is above the zero line and just starting to rise.

Scenario #2: I also plan to buy the pound today in case of two consecutive tests of the 1.2907 level when the MACD indicator is in oversold territory. This will limit downward potential and lead to a market reversal. A rise toward 1.2939 and 1.2980 can be expected.

Sell Signal

Scenario #1: I plan to sell the pound after the price breaks below 1.2907 (red line on the chart), which would lead to a sharp decline in the pair. The main target for sellers will be 1.2859, where I'll exit short positions and consider buying in the opposite direction (expecting a 20–25 point rebound). Sellers will likely gain momentum if U.S. data comes out strong. Important! Before selling, ensure that the MACD indicator is below the zero line and just starting to decline.

Scenario #2: I also plan to sell the pound today in case of two consecutive tests of the 1.2939 level when the MACD is in overbought territory. This will cap the pair's upward potential and lead to a reversal. A decline toward 1.2907 and 1.2859 can be expected.

Chart Key:

- Thin green line – entry price to buy the instrument

- Thick green line – projected price for setting a Take Profit or manually securing profit, as further growth beyond this point is unlikely

- Thin red line – entry price to sell the instrument

- Thick red line – projected price for setting a Take Profit or manually securing profit, as further decline beyond this point is unlikely

- MACD Indicator – When entering the market, it's important to consider overbought and oversold zones.

Important: Beginner Forex traders must exercise great caution when deciding to enter the market. It's best to avoid trading during the release of key fundamental reports to prevent getting caught in sharp price swings. If you choose to trade during news releases, always use stop-loss orders to minimize losses. Without them, you risk losing your entire deposit very quickly—especially if you neglect money management and trade with large volumes.

And remember: successful trading requires a clear plan, like the one outlined above. Making spontaneous decisions based on current market movements is a losing strategy for intraday traders.