The EUR/USD currency pair continued trading within a narrow range on Tuesday, showing relatively low volatility. In reality, 80 pips per day is not a bad volatility level for the euro, but traders have become accustomed to much higher values in recent months. So now, 80 pips feel like almost nothing.

Regardless, the euro has been trading sideways for three consecutive weeks. There has been little news from Donald Trump, so the market sees no reason to make significant trading decisions. All market participants are wary of Trump's surprises. If the trade war doesn't escalate further, it would make sense to buy the U.S. dollar since tariffs would either be reduced or eliminated. But who can guarantee that Trump won't raise tariffs again? Or won't he devise new ways to pressure countries worldwide to get what he wants?

If the trade conflict continues to escalate, the dollar should keep falling. However, against the euro alone, the dollar has already lost 1,000 pips in the last two months, which makes it psychologically difficult to open new long positions on EUR/USD.

Meanwhile, it has become known that Donald Trump considers his first 100 days as president in his second term a brilliant success. Despite breaking his record-low approval ratings, Trump believes things are going great. "I really enjoy reflecting on the differences between my first and second terms. Unlike the first, I now lead not only America but the entire world," Trump said during one of his daily interviews.

With statements like that, everything becomes clear. Trump is simply entertaining himself. He's 78 years old and has everything one could want in life, but lacks amusement. Running the largest economy in the world is his idea of fun. Trump doesn't feel responsible for his actions—every new development is just another attraction for him. Is there anything more to say? If running the country is a game for the U.S. president, many more surprises are in store over the next four years. What's to stop him from continuing trade wars or trying to seize Greenland by force?

Meanwhile, another motion for Trump's impeachment has been introduced in Congress—his third or fourth. Let's recall that removing Trump from office is extremely difficult because more than a simple majority is needed to pass the motion in both the House and the Senate. Given that Democrats and Republicans usually split votes nearly evenly, it's safe to assume that the two-thirds majority required won't be achieved, no matter what Trump does as president of the United States.

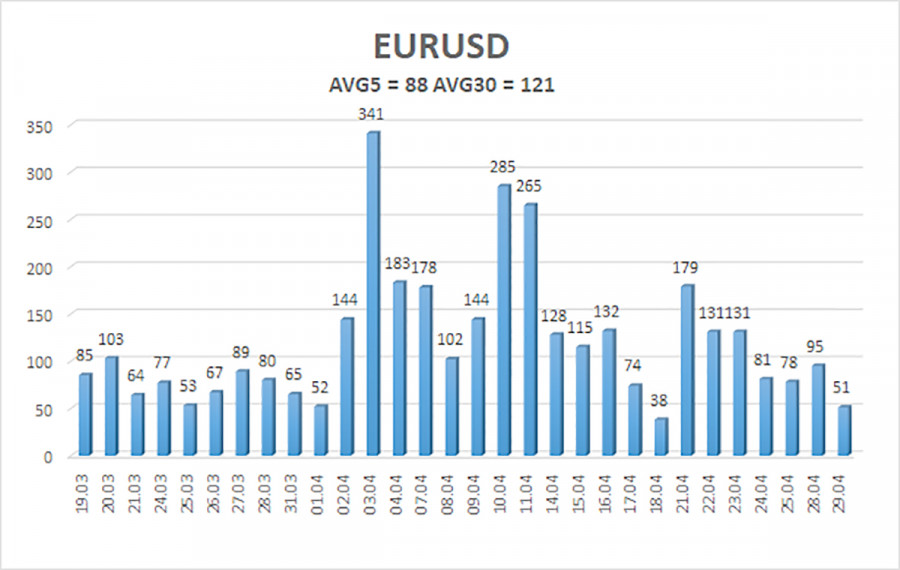

The average volatility of the EUR/USD pair over the last 5 trading days, as of April 30, is 88 pips, which is classified as "high." On Wednesday, we expect the pair to move between the levels of 1.1313 and 1.1489. The long-term regression channel is pointing upward, indicating a short-term uptrend. The CCI indicator has entered the overbought zone for the third time, suggesting a new round of corrective movement has started — though so far, it's as weak as the previous ones.

Nearest Support Levels:

S1 – 1.1230

S2 – 1.0986

S3 – 1.0742

Nearest Resistance Levels:

R1 – 1.1475

R2 – 1.1719

R3 – 1.1963

Trading Recommendations:

The EUR/USD pair continues to show a bullish trend. For months now, we've repeatedly said we expect a medium-term decline from the euro, and this outlook remains unchanged. The U.S. dollar still has no fundamental reasons for a medium-term decline—except Donald Trump. However, that single factor continues to drive the dollar into the abyss while all other market drivers are ignored. If you're trading based on "pure" technical analysis or "the Trump factor," long positions remain relevant as long as the price is above the moving average, targeting 1.1719. If the price consolidates below the moving average, short positions become formally valid with targets at 1.1230 and 1.0986, though believing in a dollar rally right now is extremely difficult. There has been no news of trade war escalation or de-escalation in recent weeks, so the market remains flat.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.