Markets in Panic: Trump Tariff Policy Shrinks Stock Market by $4 Trillion

US President Donald Trump's abrupt changes in trade policy have triggered a powerful wave of selling in the stock market. Fears of recession and instability have caused the S&P 500 to lose a whopping $4 trillion in value in just a month. Wall Street has recently embraced Trump's initiatives, but now investors are dumping assets in panic.

Crisis escalates: Stocks plummet

US stock markets were in for a shock at the start of the week, as ongoing tariff disputes and the threat of a federal government shutdown sent the stock market tumbling. All three leading US indices posted significant declines.

The S&P 500 posted its worst performance since December 18, while the tech-heavy Nasdaq plunged 4%, its biggest one-day drop since September 2022.

Trump stays silent, HSBC sounds the alarm

Amid the escalating situation, the US president chose not to comment on negative market trends. Questions about whether his trade policy could trigger a recession remained unanswered. Meanwhile, HSBC analysts have downgraded their outlook for the US stock market, citing uncertainty caused by the tariff war.

Pressure on the tech sector

Tech companies have been hit particularly hard. Their shares have come under pressure due to the strengthening Japanese yen and rising government bond yields. Investors have begun to close positions in carry trade strategies, expecting interest rates to rise in Japan.

The current instability poses serious risks to the US economy. If the situation does not change, global markets could face an even deeper crisis.

Carry trade reversal brings down the Magnificent Seven

The financial world is frozen in tension: the unwinding of capital transfer deals (carry trade) has proven a powerful catalyst for a massive sell-off in the market. The strategy of borrowing cheaply in Japanese yen and then investing in high-yielding assets has begun to falter.

Investors, fearing instability, are quickly dumping tech stocks, including the largest giants of the "Magnificent Seven" – companies associated with artificial intelligence.

Political chaos is making matters worse

Adding to the uncertainty is the crisis in the US Congress: lawmakers on Capitol Hill are unable to reach an agreement on budget spending. If the parties fail to reach an agreement, the country will face a partial government shutdown, which will inevitably worsen the panic in financial markets.

But that's not all. China is preparing to impose retaliatory tariffs on US imports as early as Monday, while Washington, in turn, plans to impose tariffs on a number of key metals. The escalation of the trade war is increasing pressure on global stock markets.

'Fear Index' Soars to Record High

Amid growing concerns, the CBOE Volatility Index (VIX), known as Wall Street's "fear index," has hit its highest since August 2024. Investors are betting on further market volatility, which is only accelerating the collapse in prices.

Stock indices are collapsing: the biggest drop in a year

- The Dow Jones lost 890.01 points (-2.08%) to 41,911.71;

- The S&P 500 plunged 155.64 points (-2.70%) to close at 5,614.56;

- The Nasdaq Composite suffered the most, falling 727.90 points (-4.00%) to 17,468.32.

Tech Under Attack

The tech sector was hit particularly hard, with tech stocks in the S&P 500 losing 4.4%, the steepest daily drop among the 11 key sectors in the index.

Growth stocks were not spared either, with a combined 3.8% decline, the biggest one-day drop since September 2022.

Global Markets on the Brink of Another Crash

Stock market volatility could intensify in the coming days. Ongoing trade tensions, the threat of a recession, and political instability are forming an explosive combination that could trigger an even bigger correction. Investors are bracing for some wild trading, but the key question remains: how deep will this decline go?

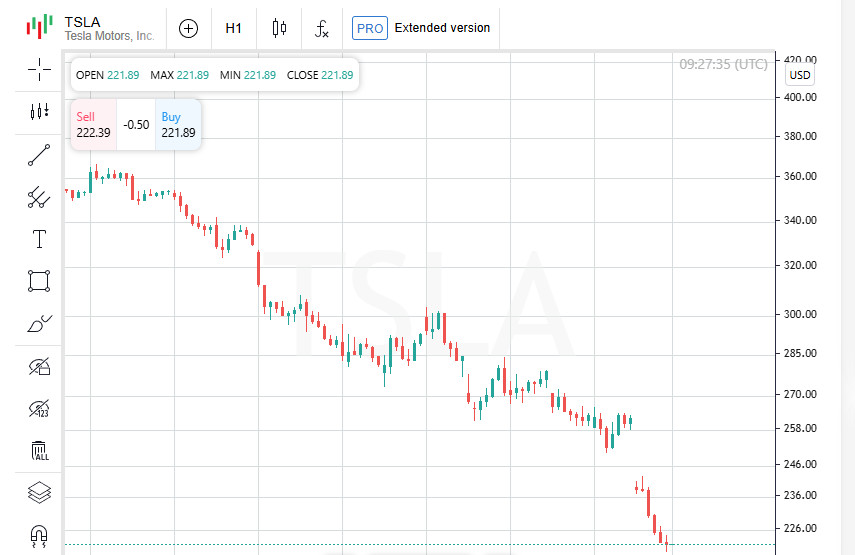

Tesla crashes: Biggest drop since 2020

Tesla (TSLA.O) shares plunged 15.4%, posting their biggest one-day decline since September 2020. Elon Musk's company has faced intense pressure following layoffs at the Department of Government Efficiency and a political scandal in which Musk openly supported far-right political forces in Europe, sparking protests and a backlash from investors.

The event dealt a major blow to confidence in the company, fueling concerns about the future of the automaker. After years of rapid growth, Tesla is now going through one of the most difficult periods in its history.

Cryptocurrency sector in the red

It's not just traditional companies that are under attack – the crypto market is also experiencing a massive correction. Coinbase (COIN.O) and MicroStrategy (MSTR.O) fell 17.6% and 16.7% respectively, following the weakening of Bitcoin. Investors are exiting digital assets en masse amid global economic uncertainty and tighter cryptocurrency regulations.

Delta Air Lines Sounds the Alarm: Profits Are Melting

The airline sector has not been spared from problems either. Delta Air Lines (DAL.N) was forced to revise its first-quarter profit forecast, cutting expectations in half. The announcement immediately caused the company's shares to fall by 14%.

CEO Ed Bastian directly pointed to growing economic instability in the United States as a major factor influencing the financial performance. This statement increased fears among investors that the country's economy could end up in a recession sooner than expected.

Political crisis worsens the situation

Political uncertainty in Washington remains the focus of investors. Lawmakers are trying to reach an agreement on funding the federal government to avoid a partial shutdown. Any delay in passing the budget could trigger a new round of turbulence in financial markets.

An additional risk factor will be the upcoming US inflation report on Wednesday. Markets are expecting the data to be worse than expected, which will further complicate the Federal Reserve's job.

Financial Inequality: The Rich Get Richer, the Poor Lose

Amid all this turmoil, the July 2024 report from the Federal Reserve Bank of St. Louis shows the gap in the financial well-being of Americans.

The bottom 50% of the US population owns only 1% of all corporate stocks and stock assets;

Meanwhile, the top 10% of the wealthiest citizens control 87% of the stock market.

This imbalance only adds to instability: while large investors can afford to wait out the crisis, the middle and lower classes bear the brunt of the losses, which could lead to increased social tensions.

Two-year rally ends

The stock market is experiencing a sharp correction after an impressive rally in 2023 and 2024. The S&P 500 has been on a steady rise of more than 20% for two years, driven largely by tech giants. But the situation has changed dramatically in 2025, with leading names like Nvidia (NVDA.O) and Tesla (TSLA.O) under intense pressure, dragging the rest of the market down with them.

Tech Crash: Apple, Nvidia, and Tesla Under Attack

The S&P 500 tech sector plunged 4.3% on Monday, one of its biggest declines in months. Apple and Nvidia each lost about 5%, with Tesla at the center of the sell-off, with its shares plunging 15%, equivalent to a loss of about $125 billion in market capitalization.

The crisis hasn't just hit the stock market. Cryptocurrencies have also been hit hard, with Bitcoin falling 5%, reflecting a general flight from risky assets.

Safe Havens Turning to Safe Havens

Despite the overall slowdown, some sectors of the economy are showing relative resilience. The utilities sector (SPLRCU) posted a 1% gain, indicating investors are shifting to traditionally safe assets. Demand for US government bonds also surged, with the yield on 10-year Treasuries falling to 4.22% as traders began to actively shift funds to safe havens.

Asia under pressure: investors flee to the yen

The crisis has also spread to Asian markets. Asian stocks fell sharply on Tuesday, continuing the trend of a global sell-off. Investors are seriously concerned that the escalating trade war could undermine US economic growth and lead to a recession.

Amid growing risks, markets have begun to seek safe havens. The Japanese yen has become the main point of attraction for capital as investors flee instability.

Trump Hints at Transition, Avoids Word Recession

Additional concerns were raised by Donald Trump's comments in an interview with Fox News. The US President spoke for the first time about a "transition" in the economy, but avoided directly answering a question about whether his trade policy could trigger a recession.

Such rhetoric has only increased anxiety in the markets. Investors fear that uncertainty around tariffs, increased volatility and decreased liquidity could create a domino effect that will drag the global economy into crisis.

What's Next? Global Markets Await More Turmoil

Experts warn that if the coming days do not bring signs of stabilization, the market could enter a protracted bearish trend. Investors are focused on the next steps of the US administration, the Fed's response and the development of the trade conflict with China.

Amid high uncertainty, the market is on the threshold of a new chapter, where every statement and economic indicator could become a trigger for the next collapse.

Risky assets under attack

Volatility in global markets is growing. Donald Trump's recent comments and recession fears have forced investors to abandon risky assets, triggering a new round of selling. Pressure has increased not only on the stock market, but also on the US dollar, which has weakened and Treasury yields have continued to fall.

Asian exchanges in the red

The financial storm has also hit Asian markets. Japan's Nikkei and Taiwan's TWII have hit their lowest levels since September, while Australia's ASX 200 index has fallen 0.8%, hitting a seven-month low.

Even Chinese stocks, which have shown strong growth this year, have come under pressure. The CSI 300 index has lost 0.5%, while Hong Kong's Hang Seng has fallen 1%, reflecting growing pessimism among investors.

The market has lost $4 trillion, but investors are looking for support

The panic on the stock exchanges has wiped out $4 trillion in the S&P 500 market capitalization in just a month, demonstrating the scale of the collapse. However, signs of stabilization have begun to appear in S&P and Nasdaq futures, which partially recouped their morning losses in Asia and moved into positive territory ahead of the start of European trading.

European stock futures showed similar dynamics, indicating a relatively stable opening of trading in the region. However, analysts warn that the situation remains extremely fragile, and any negative event could trigger a new wave of sell-offs.

Investors are waiting for Trump's reaction

Prashant Newnaha, a strategist at TD Securities, noted that many investors expect Trump to be forced to reconsider his policies if the stock market decline continues. However, for now the White House is maintaining tough rhetoric, which only increases uncertainty.

The Japanese Yen is the Main Haven for Capital

Amid market turmoil, investors are actively moving capital into safe haven assets. The Japanese yen reached a five-month high against the dollar, rising to 147.35 per dollar before partially correcting. However, in 2025, the yen has already risen by 7% against the dollar, confirming its status as one of the main safe haven assets in times of turbulence.

The situation remains extremely tense. Global markets are balancing on the brink of a new crisis, and investors are closely monitoring the next steps of the US administration and the development of the trade war. In the coming days, key triggers will be speeches by Fed officials, macroeconomic data, and Trump's statements.

For now, the main questions remain unanswered: will this be a short-term panic or the beginning of a full-fledged financial storm?

Swiss Franc and Yen Continue to Rise

Amid high market volatility, investors continue to seek safe havens, which is causing safe haven currencies to strengthen. The Swiss franc hit a three-month high, remaining at 0.8791 per dollar on Tuesday. Such demand for the franc is explained by capital flight from the dollar and growing concerns about the US economic policy.

In parallel, the dollar index, which tracks the US currency against six major currencies, fell to a four-month low. It has already lost more than 4% since the beginning of the year, which indicates growing skepticism among investors about the sustainability of the US economy.

Trump does not change course: trade policy under attack

Unlike his first term, when economic problems could have forced Donald Trump to reconsider his trade strategy, this time he seems to be determined. Kyle Rodda, senior financial markets analyst at Capital.com, noted that the president is not going to back down, despite the negative consequences for the stock market and the economy as a whole.

This means investors should brace for longer-term instability, ongoing trade disputes and the potential for increased recessionary risks.

Oil stays afloat, but demand is in question

Oil prices remain relatively stable despite concerns about a slowing global economy. Investors are concerned that new US tariffs could reduce global energy demand, putting pressure on the oil market.

At the same time, OPEC+ countries continue to increase production, which could lead to a supply glut and further price declines.

Gold close to record

Amid economic uncertainty, gold continues to strengthen, approaching an all-time high. On Tuesday, the precious metal rose to $2,895.75 an ounce, just a few dollars below its peak last month.

Investors view gold as a key safe haven asset, especially against the backdrop of a weaker dollar and instability in the stock market. Since the beginning of 2025, gold has risen by 10%, and last year its growth was an impressive 27%.

The situation remains extremely tense. Investors are watching the White House, the Fed's decisions, and the dynamics of the trade conflict. In the coming days, key factors such as new macroeconomic data and possible comments from Trump could influence the future dynamics of the markets. But one thing is clear: the global economy is entering a new phase of instability, and investors will have to adapt to the new reality.