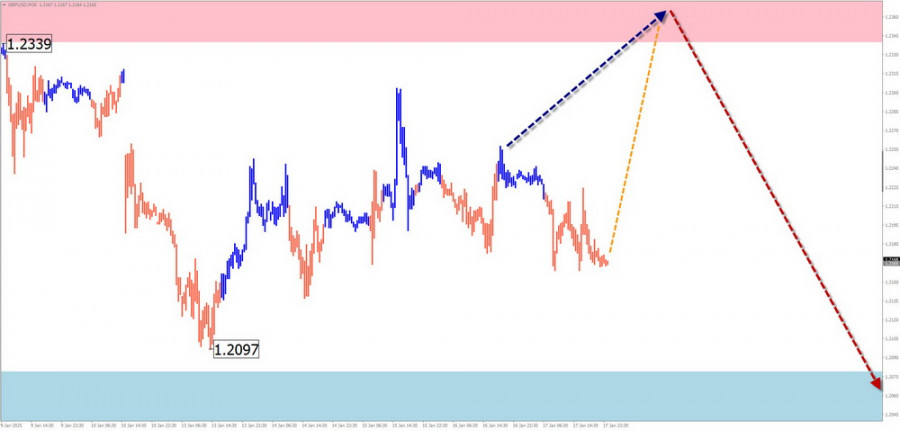

GBP/USD

Analisis:Struktur gelombang terbaru untuk GBP/USD, yang dimulai pada bulan Ogos tahun lalu, masih belum lengkap dan sedang menurun. Bahagian ini berfungsi sebagai pembetulan dalam gelombang yang lebih besar. Sepanjang minggu lalu, pasangan tersebut telah membentuk penarikan sederhana.

Ramalan:Minggu ini, GBP/USD kemungkinan akan terus bergerak secara mendatar dalam pola datar. Kenaikan ringkas ke arah rintangan adalah mungkin pada hari-hari awal, diikuti oleh pembalikan dan pergerakan menurun. Ketidakstabilan dijangka akan meningkat semakin hujung minggu.

Zon Pembalikan Berpotensi:

- Rintangan: 1.2340–1.2390

- Sokongan: 1.2080–1.2030

Cadangan:

- Beli: Potensi terhad dan risiko tinggi.

- Jual: Pertimbangkan perdagangan selepas isyarat pembalikan berhampiran zon rintangan disahkan oleh sistem perdagangan anda (TS).

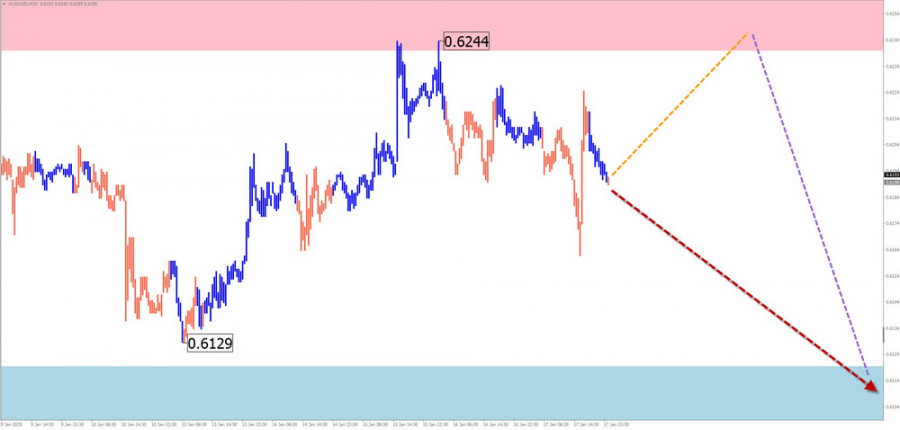

AUD/USD

Analisis: Gelombang menurun untuk AUD/USD, yang bermula pada 30 September tahun lalu, telah membawa harga ke zon pusingan potensi yang signifikan. Sepanjang bulan yang lalu, gelombang telah membentuk pembetulan mendatar dalam bentuk struktur datar yang berubah, yang masih belum lengkap.

Ramalan: Pasangan ini dijangka akan terus bergerak secara mendatar minggu ini. Selepas tekanan berpotensi pada zon rintangan, pembalikan dan pergerakan menurun ke arah sokongan adalah mungkin.

Zon Pembalikan Berpotensi:

- Rintangan: 0.6240–0.6290

- Sokongan: 0.6120–0.6070

Saranan:

- Beli: Risiko tinggi, mungkin mengakibatkan kerugian.

- Jual: Dipercepat tanpa isyarat pusingan balik yang disahkan berhampiran rintangan.

USD/CHF

Analisis: Arah jangka pendek untuk USD/CHF telah ditentukan oleh gelombang menaik sejak Ogos tahun lalu, yang masih belum lengkap. Skala gelombang melebihi carta masa H4, dan harga telah melanggar zon rintangan sederhana. Pembetulan sepertinya perlu.

Prakiraan: Pada hari-hari awal minggu ini, harapkan pergerakan mendatar dengan tekanan yang mungkin pada had bawah zon sokongan. Berikutnya, pembalikan semula dan lanjutan menaik berpotensi, dengan rintangan di tepi bawah zon sasaran awal gelombang.

Zon Pembalikan Potensi:

- Rintangan: 0.9290–0.9340

- Sokongan: 0.9130–0.9080

Saranan:

- Jual: Tiada potensi dan risiko tinggi.

- Beli: Pertimbangkan setelah isyarat pembalikan disahkan dalam zon sokongan.

EUR/JPY

Analisis:Sejak akhir Disember, EUR/JPY telah membentuk gelombang menurun, membetulkan bahagian terkini dari trend global. Gelombang membentuk struktur datar yang terbentang dan masih belum selesai.

Ramalan:Mengharapkan pergerakan secara keseluruhan secara mendatar minggu ini. Setelah tekanan potensi pada zon rintangan, pembalikan dan sambungan menurun adalah mungkin. Sokongan dikira terletak di sempadan atas zon sasaran preliminari gelombang.

Zon Pembalikan Berpotensi:

- Rintangan: 161.00–161.50

- Sokongan: 159.20–158.70

Cadangan:

- Beli: Potensi terhad dan risiko tinggi.

- Jual: Menjadi layak setelah isyarat pusingan yang disahkan dalam zon rintangan.

EUR/CHF

Analisis:Sejak akhir November, EUR/CHF telah menunjukkan aliran meningkat. Bahagian gelombang terkini, yang belum lengkap, adalah ke bawah, berfungsi sebagai pembetulan dalam aliran menaik yang lebih luas.

Prakiraan:Dalam beberapa hari akan datang, harapkan pergerakan mendatar atau penurunan sedikit, tetapi tidak di bawah sokongan yang dihitung. Kelanjutan pergerakan ke atas lebih mungkin pada akhir minggu. Rintangan yang dihitung sejajar dengan had bawah zon sasaran sementara.

Zon Pusingan Potensi:

- Rintangan: 0.9440–0.9490

- Sokongan: 0.9370–0.9320

Cadangan:

- Jual: Risiko tinggi dan boleh menyebabkan kerugian.

- Beli: Pertimbangkan dagangan selepas isyarat pusingan yang disahkan di dalam zon sokongan.

Indeks Dolar AS

Analisis: Selepas tempoh pertumbuhan yang tetap, Indeks Dolar AS sedang mengalami pembetulan. Gelombang telah bermula pada awal tahun dan masih belum selesai, membentuk struktur mendatar yang berubah. Zon sasaran awal selaras dengan tahap sokongan yang signifikan pada jangka masa terbesar.

Ramalan awal: Pada permulaan minggu, dijangka akan ada pergerakan mendatar sepanjang zon sokongan. Meningkatkan ketidakstabilan, pusingan dan peningkatan semula aliran dolar mungkin berlaku pada akhir minggu.

Zon Pembalikan Berpotensi:

- Rintangan: 109.80–110.00

- Sokongan: 108.70–108.50

Cadangan:

- Jual: Berisiko, dengan potensi yang terhad untuk penurunan dolar.

- Beli: Kelemahan dalam pasangan mata wang utama terhadap dolar menawarkan peluang yang menguntungkan.

Nota tentang Analisis Gelombang Ringkas (SWA):

- Semua gelombang dalam SWA terdiri daripada tiga bahagian (A-B-C). Analisis tertumpu pada gelombang yang terakhir, tidak lengkap pada setiap skala masa.

- Garisan berpusat menunjukkan pergerakan yang dijangka.

- Perhatian: Algoritma gelombang tidak mengambil kira tempoh pergerakan harga sepanjang masa.