Analysis of Tuesday's Trades:

GBP/USD on 1H Chart

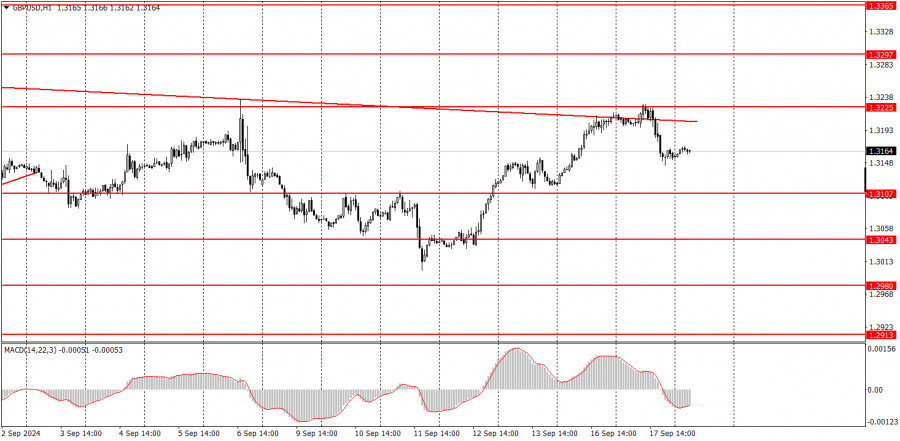

The GBP/USD pair tested the 1.3225 level again on Tuesday but failed to break through it and subsequently pulled back. We believe the pair's decline was triggered by this rebound, especially since the descending trendline also runs around the 1.3225 level. Therefore, we can still conclude that the downtrend remains intact for now. However, the British pound has been rising persistently in the past few days without any grounds or reasons. How the market will react to the Federal Reserve's evening meeting remains a big question. We certainly support a further decline in the British currency, which remains overbought and excessively expensive, but the market may continue to price in the Fed's monetary easing for some time. All other factors seem to be of little interest to it.

GBP/USD on 5M Chart

In the 5-minute time frame on Tuesday, two sell signals were generated around the 1.3225 level. Unlike the euro's signal, the signals for the pound were very accurate and of high quality. Therefore, novice traders had a good opportunity to open short positions. The pair then precisely worked through the 1.3145-1.3167 area, where short positions could have been closed. The profit amounted to around 60 pips.

How to Trade on Wednesday:

In the hourly time frame, GBP/USD has a good chance of resuming the global downtrend or undergoing a significant correction, but we haven't seen either. The British pound remains overbought, the dollar is undervalued, and the market is still much more inclined to sell the dollar than to buy it. So far, the pound has only slightly corrected downward. It is still too early to talk about a full-fledged downtrend. If the price breaks through the 1.3225 level, it will further reduce the dollar's chances of growth in the near future.

On Wednesday, the pair may attempt to resume its decline, as it has failed twice to break through the 1.3225 level. However, if it consolidates above this level, we can expect further growth of the British currency.

In the 5-minute time frame, you can currently trade around the levels of 1.2748, 1.2791-1.2798, 1.2848-1.2860, 1.2913, 1.2980-1.2993, 1.3043, 1.3102-1.3107, 1.3145-1.3167, 1.3225, 1.3272, 1.3310, 1.3365. No significant events are scheduled in the UK for Wednesday, while in the U.S., reports on new home sales and building permits will be released. We do not expect a reaction of more than 20 pips from this data. All attention is on the Fed meeting.

Basic Rules of the Trading System:

1) The strength of a signal is determined by the time it takes for the signal to form (bounce or level breakthrough). The less time it took, the stronger the signal.

2) If two or more trades were opened around any level due to false signals, subsequent signals from that level should be ignored.

3) In a flat market, any currency pair can form multiple false signals or none at all. In any case, it's better to stop trading at the first signs of a flat market.

4) Trades should be opened between the start of the European session and midway through the U.S. session. After this period, all trades must be closed manually.

5) In the hourly time frame, trades based on MACD signals are only advisable amidst good volatility and a trend confirmed by a trendline or trend channel.

6) If two levels are too close to each other (5 to 20 pips), they should be considered a support or resistance area.

7) After moving 20 pips in the intended direction, the Stop Loss should be set to break even.

What's on the Charts:

Support and Resistance price levels: targets for opening long or short positions. You can place Take Profit levels around them.

Red lines: channels or trend lines that depict the current trend and indicate the preferred trading direction.

The MACD indicator (14,22,3): encompassing both the histogram and signal line, acts as an auxiliary tool and can also be used as a source of signals.

Important speeches and reports (always noted in the news calendar) can profoundly influence the movement of a currency pair. Hence, trading during their release calls for heightened caution. It may be reasonable to exit the market to avoid sharp price reversals against the prevailing movement.

For beginners, it's important to remember that not every trade will yield profit. Developing a clear strategy and effective money management is key to success in trading over the long term.