GBP/USD 5-Minute Analysis

The GBP/USD currency pair remained flat throughout Thursday, despite several attempts to continue its decline. The 1.2516 level has proven to be strong support for the pound sterling, successfully preventing the pair from falling below it three times this week. While volatility for the pound is slightly higher than that of the euro, this does not create meaningful trading opportunities. Trading on the 5-minute timeframe currently seems ineffective. Therefore, there are two options: either wait for the new year or trade on the 4-hour timeframe or higher, where positions can be held for a week or more.

In the context of a "thin" market, there is still a possibility that the pair could breach the 1.2516 level before the year ends. However, such a breach is unlikely to result in significant movement. The downtrend remains intact across all higher timeframes, including the hourly charts. Consequently, we expect further declines.

Formally, a single trading signal was generated on the 5-minute timeframe yesterday. During the early U.S. session, the price rebounded from the 1.2516 level, but whether it was advisable to act on this signal, given the current volatility, is highly debatable.

COT Report

COT reports for the British pound reveal that the sentiment among commercial traders has been consistently shifting over recent years. The red and blue lines, representing the net positions of commercial and non-commercial traders, frequently intersect and mostly hover near the zero mark. Currently, the price first broke through the 1.3154 level and then fell back to the trendline. A price consolidation below the trendline is likely. The first rebound from it (technically, the fourth attempt) was very weak. The chart suggests that the next attempt could be successful, potentially leading to a sharp drop.

According to the latest COT report on the British pound, the Non-commercial group closed 14,500 BUY contracts and 9,000 SELL contracts, reducing the net position by another 5,500 contracts over the week.

The fundamental backdrop still does not justify long-term purchases of the pound sterling. On the contrary, the currency has a real chance of resuming its downward trend globally. For now, the trendline is preventing the pound from further declines. However, if the trendline doesn't allow the price to break lower, another upward move above 1.3500 could occur. But what fundamental reasons currently support such a scenario? After all, the pound cannot continue rising indefinitely without solid grounds.

GBP/USD 1-Hour Analysis

On the hourly timeframe, the GBP/USD pair continues to show a bearish bias, indicating that the three-week corrective phase has come to an end. There is still no fundamental reason for the pound to exhibit any significant growth, aside from occasional technical corrections. Although the meetings of the Bank of England and the Federal Reserve had the potential to negatively impact the U.S. dollar, they ultimately have hurt the pound instead. In the medium term, we anticipate further declines in the value of the British currency.

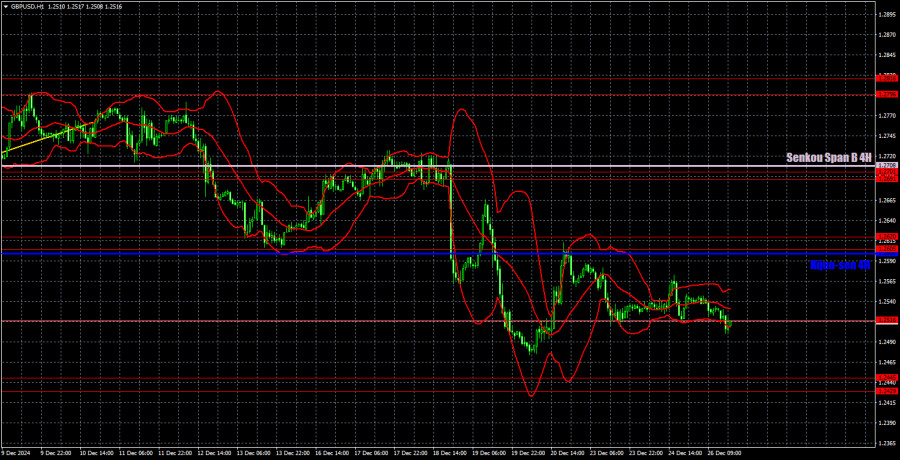

For December 27, we identify the following key levels: 1.2349, 1.2429-1.2445, 1.2516, 1.2605-1.2620, 1.2691-1.2701, 1.2796-1.2816, 1.2863, and 1.2981-1.2987. The Senkou Span B at 1.2708 and the Kijun-sen at 1.2600 can also be sources of signals. It is advisable to set a Stop Loss at break-even once the price moves 20 pips in your favor. Note that the Ichimoku indicator levels may shift during the day and should be monitored when determining trading signals.

There are no significant events or reports scheduled for Friday in either the UK or the US. As a result, there will be little to analyze, with the focus likely centered on the 1.2516 level. Market behavior around this level will be critical in determining potential movements.

Illustration Explanations:

Support and Resistance Levels (thick red lines): Key areas where price movement might stall. Not sources of trading signals.

Kijun-sen and Senkou Span B Lines: Ichimoku indicator lines transferred from the H4 timeframe to the hourly chart, serving as strong levels.

Extreme Levels (thin red lines): Points where the price has previously rebounded. They can serve as trading signal sources.

Yellow Lines: Trendlines, channels, or other technical patterns.

Indicator 1 on COT Charts: Reflects the net position size of each trader category.