The GBP/USD currency pair traded relatively calmly on Tuesday, but Monday brought a full-on whirlwind to the markets. For several days now, we've been using terms like "storm," "chaos," and "madness" in our articles—but even those words fall short for Monday. In addition to everything that happened and was already widely reported by global media, Monday also saw the emergence of several fake news stories. The market is in a state of panic, being thrown from side to side, and someone is making good money spreading false information. We won't guess who that might be, but we have suspicions.

On Monday, during the start of the U.S. trading session, a message surfaced that Trump might suspend all newly imposed tariffs—except those on China—for 90 days. Markets immediately began to rebound, anticipating negotiations and a softer phase of the trade war. However, a couple of hours later, the White House stated that the U.S. president had never said anything such. Moreover, Trump declared that he planned to impose an additional 50% tariff on Chinese imports if Beijing responded with countermeasures. Is there any doubt about how China will respond?

Also, on Monday evening, news broke that the Federal Reserve was calling an emergency meeting. That brought a fresh wave of rumors, opinions, and speculation into the market. Some analysts believe the Fed will cut rates five times in 2025—once at every meeting. This view stems from concerns that the U.S. economy is headed for a recession if Trump's tariffs remain in place and that the Fed will have to "bite the bullet" to contain the fallout. Others argue that the Fed won't cut rates even once, especially after Jerome Powell stated last Friday that bringing inflation down to 2% remains the central objective.

We understand Powell's stance—likely that of the entire Fed. Powell doesn't want to participate in the circus initiated by Trump willingly. If Powell begins cutting rates to "save the economy," Trump will always be able to say the Fed "waited too long," "cut too slowly," and "Powell didn't listen to Trump eight years ago, so it's all his fault." On the other hand, if Powell stays out of it, everyone will see that there's only one conductor of the U.S. economy—and that's Trump. Consequently, Trump alone will be blamed for any recession. Democrats are already preparing a third attempt at impeachment, and protests against the sitting president are erupting across the country, while Trump calmly plays golf and gives interviews to his personal journalists, constantly repeating that he has won, will win, and is a winner.

In short, it's far too early to relax. The storm has only begun, and attempting to forecast market movements even a few hours ahead is pointless. No one knows when Trump will announce the next set of tariffs—or when the next wave of disinformation will ripple through the market, giving someone a chance to profit significantly.

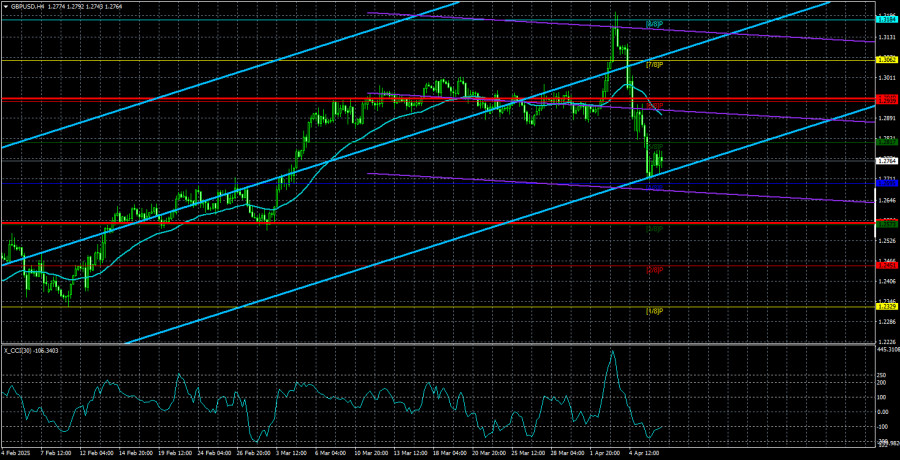

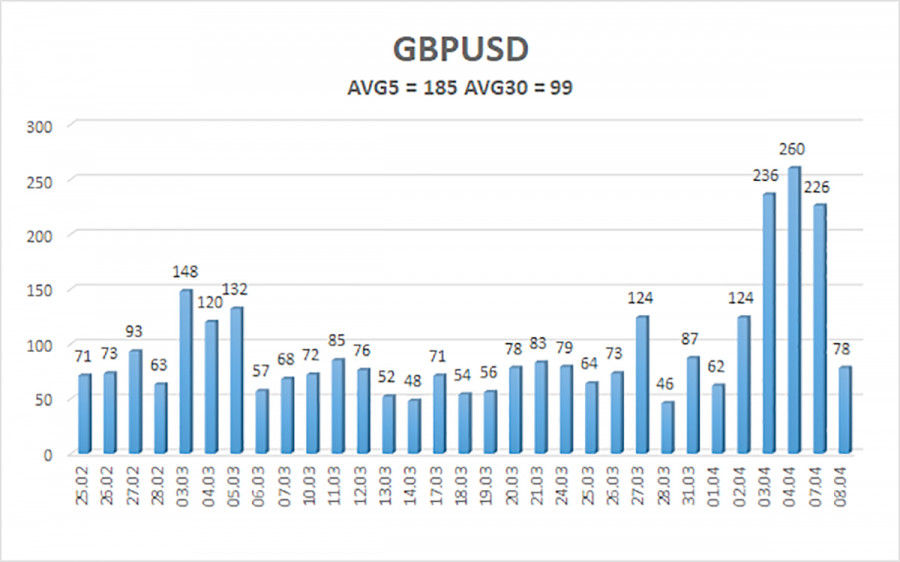

The average volatility of the GBP/USD pair over the last five trading days is 185 pips, which is classified as "high." On Wednesday, April 9, we expect movement within the range of 1.2579 to 1.2949. The long-term regression channel is directed upward, but a downward trend persists on the daily timeframe. The CCI indicator has entered the overbought zone, indicating the beginning of a downward correction. The correction has already started abruptly...

Nearest Support Levels:

S1 – 1.2695

S2 – 1.2573

S3 – 1.2451

Nearest Resistance Levels:

R1 – 1.2817

R2 – 1.2939

R3 – 1.3062

Trading Recommendations:

The GBP/USD pair has sharply entered a decline, which could develop into a prolonged correction or even a trend we've been anticipating for the past few months. We still don't consider long positions valid, as we believe the entire upward movement was a correction on the daily timeframe that has now become irrational. However, if you trade purely on technical signals, long positions remain viable with targets at 1.3084 and 1.3184—if the price consolidates above the moving average again. The pound may resume growth if Trump increases tariffs and other countries impose retaliatory tariffs. Sell orders remain attractive with targets at 1.2207 and 1.2146, as the upward correction on the daily TF will eventually end—unless the broader downtrend ends first. Even if we're now witnessing the beginning of a new uptrend, a solid downward correction is needed, as the pound has risen too much in recent weeks.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.