signal strength 3 of 5

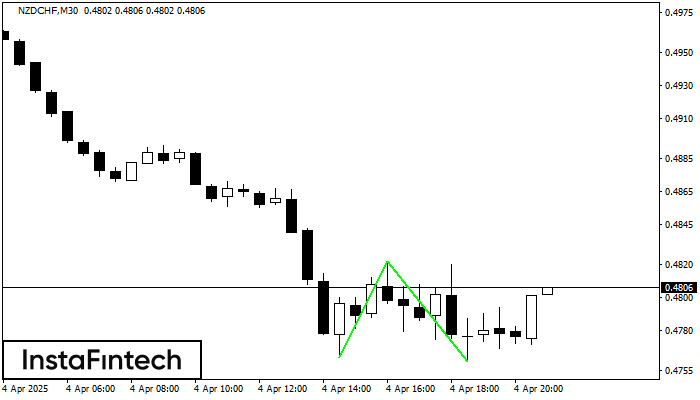

The Double Bottom pattern has been formed on NZDCHF M30. This formation signals a reversal of the trend from downwards to upwards. The signal is that a buy trade should be opened after the upper boundary of the pattern 0.4822 is broken. The further movements will rely on the width of the current pattern 59 points.

See Also

- All

- Double Top

- Flag

- Head and Shoulders

- Pennant

- Rectangle

- Triangle

- Triple top

- All

- #AAPL

- #AMZN

- #Bitcoin

- #EBAY

- #FB

- #GOOG

- #INTC

- #KO

- #MA

- #MCD

- #MSFT

- #NTDOY

- #PEP

- #TSLA

- #TWTR

- AUDCAD

- AUDCHF

- AUDJPY

- AUDUSD

- EURCAD

- EURCHF

- EURGBP

- EURJPY

- EURNZD

- EURRUB

- EURUSD

- GBPAUD

- GBPCHF

- GBPJPY

- GBPUSD

- GOLD

- NZDCAD

- NZDCHF

- NZDJPY

- NZDUSD

- SILVER

- USDCAD

- USDCHF

- USDJPY

- USDRUB

- All

- M5

- M15

- M30

- H1

- D1

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

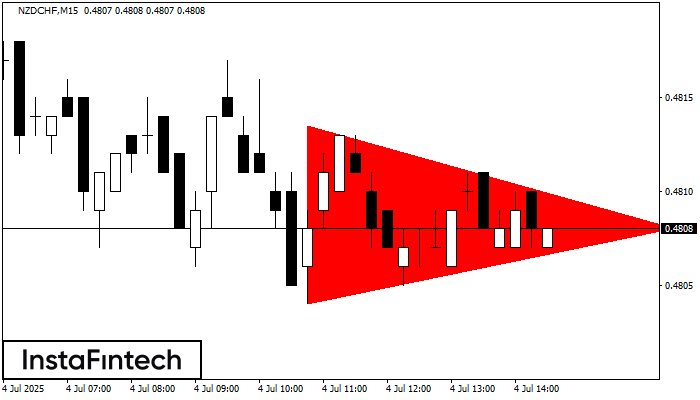

According to the chart of M15, NZDCHF formed the Bearish Symmetrical Triangle pattern. Trading recommendations: A breach of the lower border 0.4804 is likely to encourage a continuation

The M5 and M15 time frames may have more false entry points.

Open chart in a new windowThe Double Bottom pattern has been formed on GBPJPY M5. Characteristics: the support level 196.96; the resistance level 197.12; the width of the pattern 16 points. If the resistance level

The M5 and M15 time frames may have more false entry points.

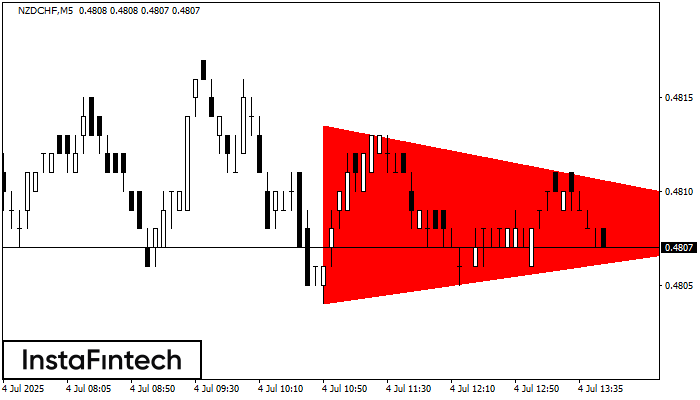

Open chart in a new windowAccording to the chart of M5, NZDCHF formed the Bearish Symmetrical Triangle pattern. This pattern signals a further downward trend in case the lower border 0.4804 is breached. Here

The M5 and M15 time frames may have more false entry points.

Open chart in a new window